Guaranteed Investing: Finding Peace of Mind in Uncertain Times

In a world full of uncertainty—whether it's rising interest rates, market volatility, or global unrest—it’s completely normal to feel a little uneasy about where your money is going. The good news? You don’t have to take big risks to grow your savings. In fact, guaranteed investing might be your best move right now.

Why Guaranteed Investments?

When everything feels unstable, guaranteed investments can offer a sense of control. You know exactly what you're getting—no surprises, no sudden losses. That’s powerful peace of mind.

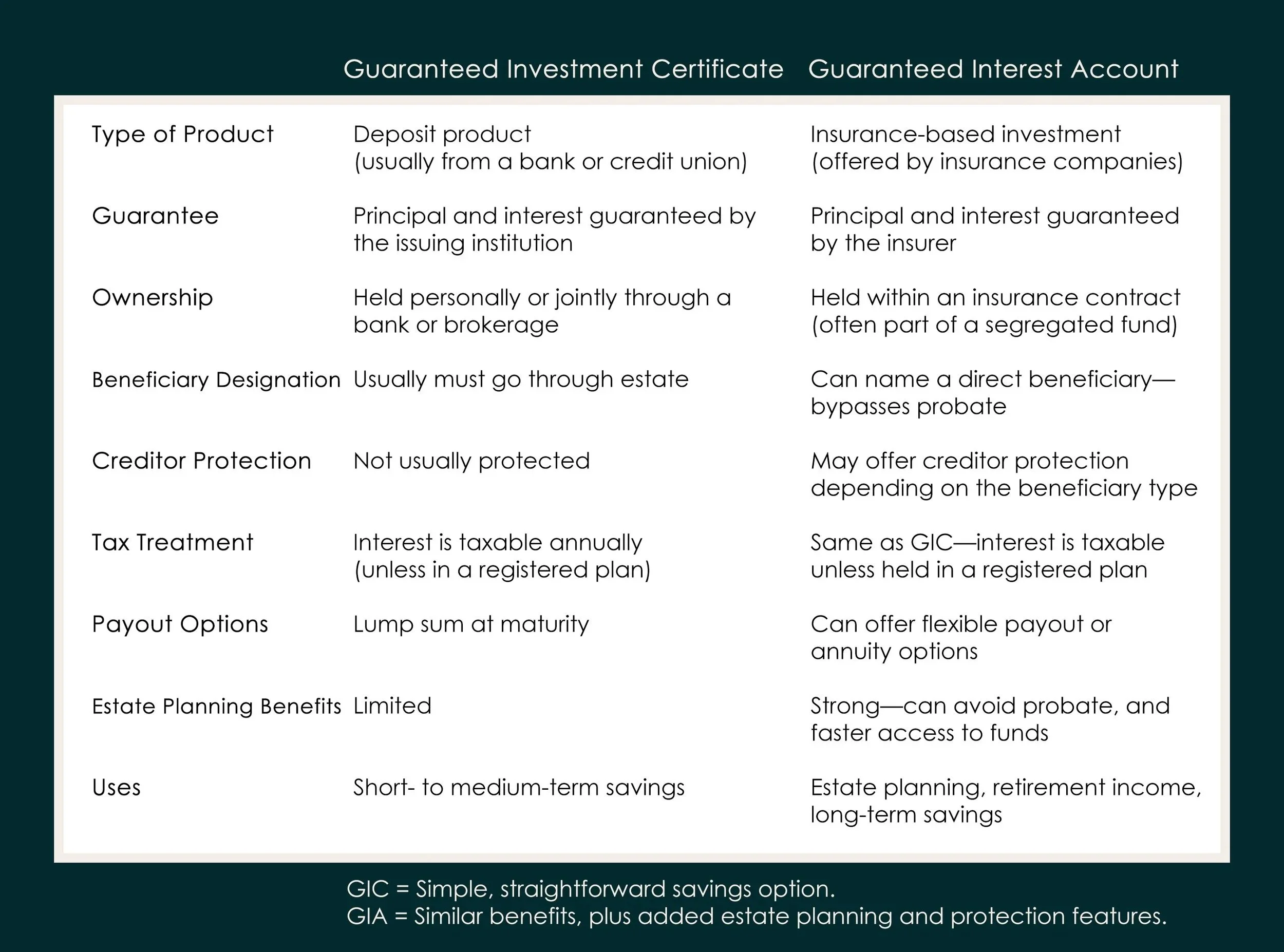

Two popular options for guaranteed investing in Canada are:

🔐 GIC (Guaranteed Investment Certificate)

Offered through banks and credit unions

Guarantees your principal and interest

Ideal for short- to medium-term savings

Simple and secure—but typically must pass through your estate

🛡️ GIA (Guaranteed Interest Account)

Offered through insurance companies

Works similarly to a GIC but comes with additional benefits

Allows you to name a beneficiary, so the funds can bypass probate

May offer creditor protection, depending on the type of beneficiary

A great tool for longer-term planning, retirement income, or estate strategies

What’s Right for You?

Both GICs and GIAs are strong, low-risk options—but they serve slightly different purposes. If you're simply looking to park your money safely, a GIC may be all you need. But if you're thinking long-term, value estate planning, or want to ensure faster access to funds for loved ones, a GIA might be the better choice.

The Bottom Line

You don't have to chase high-risk investments to grow your money. In times like these, security is strategy.

If you're looking for stable growth, estate planning advantages, and a way to feel confident about your financial future, let’s talk about whether a GIC or GIA is the right fit for you.

Contact me today to explore your options. Peace of mind could be one conversation away.